Roof Replacement Cost Financing & Payment Plans Explained

Key Takeaways

- Roof financing helps you get a new roof without paying the full cost up front.

- The most popular options are HELOC, home equity loan, personal loan, or contractor financing with zero down options.

- Monthly payments depend on your loan term, interest rate, and roof replacement cost.

- Always compare multiple financing offers along with at least two roof replacement quotes.

- A roof replacement cost calculator helps you estimate both the total cost and the expected monthly payment.

How to Finance Your Roof Replacement in 2026

You can finance a roof replacement through a home equity loan, HELOC, personal home improvement loan, contractor financing with monthly payment plans, or promotional zero-down offers. These options allow homeowners to replace their roof immediately and pay the total amount over several months or years.

Financing is now a common choice for homeowners because roof costs are high, and delaying repairs can cause expensive structural damage. Financing helps you fix the problem before it becomes worse.

To understand how roofing prices are calculated before you choose a financing plan, read The Complete Homeowner’s Guide to Roof Replacement Cost in 2025.

Why Roof Replacement Financing Makes Sense

Financing makes sense when the cost of a new roof is too high to pay at once. It allows you to protect your home now and pay the cost through manageable monthly payments instead of draining your savings.

A new roof can cost anywhere from several thousand dollars to tens of thousands of dollars. Many homeowners prefer payment plans that offer predictable and flexible monthly installments. Roof financing also helps you avoid the risk of water leaks, mold issues, and structural damage that can occur when a roof is delayed.

Top Roof Financing Options for Homeowners

Below are the most common ways homeowners finance a roof replacement. Each option includes direct answers and simple explanations so readers can understand which option fits them best.

| Financing Option | How It Works | Best For | Key Advantage |

|---|---|---|---|

| Personal Loan | Borrow a fixed amount with fixed payments | Quick approvals | No home equity required |

| Home Equity Loan | Borrow using home equity | Lower interest rates | Best for large projects |

| HELOC | Revolving credit line | Flexible spending | Pay interest only on the used amount |

| Contractor Financing | Offered by roofing companies | One-step process | No bank involvement |

| Credit Cards | Use the available credit limit | Small repairs | Good for temporary financing |

| Government and Utility Programs | Local rebates and loans | Energy-efficient roofs | Reduce total cost |

Want help understanding which option fits your roofing project? Ask for a personalized financing guide.

Personal Loans for Roof Replacement

Personal loans give fast access to funds. Many roofing companies recommend this for urgent roof repair or for a complete roof replacement after storms.

Personal loans help homeowners pay for:

- Asphalt shingles

- Affordable roofing material

- Metal roofing upgrades

- Roof flashing repair

About 40 percent of home improvement loans across the country are used for roof repair and roof installation.

Home Equity Loans for Roofing

A home equity loan has predictable monthly payments and often the lowest interest rates. It is ideal when your square footage is large or when you want premium materials like slate roofs or copper roofing, which are some of the most expensive roofing materials.

Because the average roof replacement cost keeps increasing, many homeowners prefer this long-term, stable financing structure.

HELOC Financing

A HELOC works like a credit line. Use it when your roof replacement project includes phased work, such as:

- Shingle repair

- Replacement of wood roofs

- Upgrading to an aesthetically pleasing roofing system

- Roof flashing improvements

- Installing architectural shingles

You pay interest only on the amount you use, which helps save money during the installation process.

Contractor Financing Available from Roofing Companies

Many roofing contractors and roofing companies now offer in-house financing. This makes the installation of the roof smoother because you deal with only one team.

Homeowners like this option because:

- No need to visit a bank.

- No separate approval process

- Direct free cost estimate

- Perfect for both small roof repair costs and large full roof replacement.

More than half of all roofing businesses offer financing plans as a way to remain competitive.

Government Roofing Programs

Some states offer:

- Zero-interest loans

- Utility rebates

- Incentives for cool roofs

- Discounts for solar-ready metal roofing

Energy-efficient roofing materials can reduce cooling bills by up to 15 percent, according to the Department of Energy.

This helps offset the replacement cost and encourages homeowners to choose long-lasting materials whose perks encompass extended lifespan.

Contractor Financing from Roofing Companies

The easiest way to fund a roof replacement project may be contractor financing, mainly because roofing contractors offer simple, in-house payment plans.

Why Homeowners Prefer Contractor Financing

- No bank visit: You apply directly through the roofing installer, which saves time.

- No separate approval process: The contractor handles the paperwork and coordinates with the lender.

- Direct free cost estimate. You will get your instant roof replacement cost calculation.

- Works for small repairs and full roof replacement. Useful whether you need minor repairs or a completely new roof.

- Over half of roofing companies now offer financing to help homeowners cope with rising roof replacement costs.

Use our roof replacement cost calculator and ask your roofing installer if they offer in-house financing programs.

Government Roofing Programs

Government and utility programs help reduce the total cost of a new roof, especially when you choose energy-efficient roofing materials.

What These Programs Include

- Zero-interest loans

Helpful when you need predictable payments for a full roof replacement.

- Utility rebates

Some utility companies refund part of your roof replacement cost.

- Incentives for cool roofs

Cool roofing materials reduce heat absorption and lower energy bills.

- Discounts for solar-ready metal roofing

Solar-compatible metal roofing can qualify for additional savings.

Energy-efficient roofs can cut cooling costs by up to 15 percent, according to the Department of Energy, which makes them a smart long-term investment.

How to Choose the Best Financing Option

Choosing the right financing depends on the size, style, and complexity of your roofing project.

- Roof style

Different roof styles affect labor costs and overall installation time.

- Roof size

Larger square footage increases both material costs and replacement costs.

- Roof complexity

A steeper roof pitch or multiple roof levels raise the total cost.

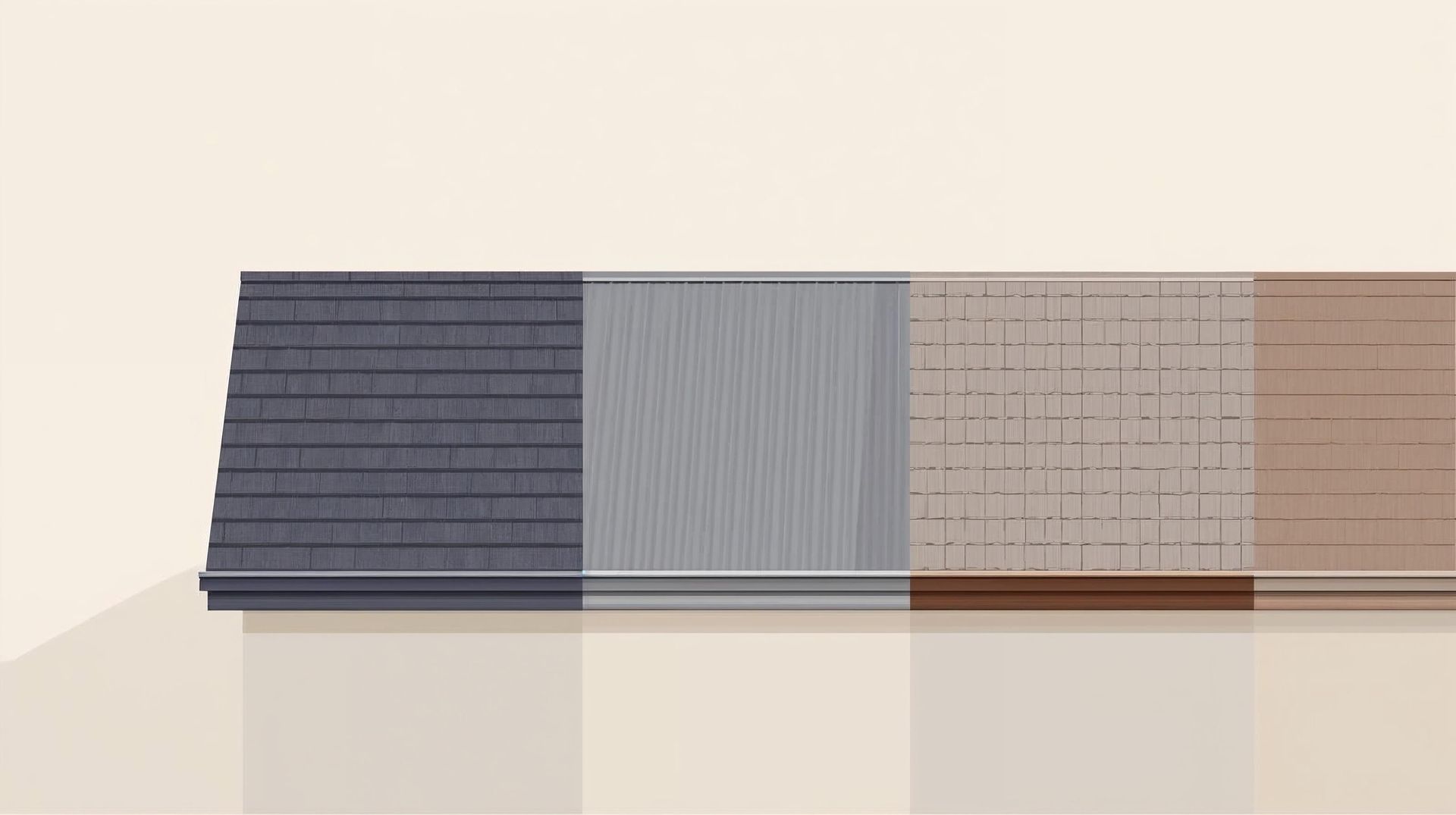

- Type of roofing material

Asphalt shingles, metal roofing, tile roofs or slate tiles each have different price points.

- Actual cost of material and labor

Premium materials and skilled installers increase the total project cost.

- Whether you need repairs or a complete roof replacement

Minor repairs cost less while full installations require financing support.

If you want the lowest long-term cost, choose home equity loans or HELOC. If fast approval matters most, choose personal loans or contractor financing.

Before choosing a financing plan, check your exact roof replacement cost with our free roof replacement cost calculator.

Tips to Improve Approval Chances

Lenders approve faster when your financial and roofing information is clear and complete.

Simple Steps to Follow

- Check your credit score

Higher scores lead to better interest rates.

- Organize income documents

Lenders check income stability before approving roof financing.

- Obtain repair estimates

A written roof repair estimate shows the actual cost of your roofing project.

- Conduct a roof inspection

A roof inspection helps lenders understand the current condition of your existing roof.

- Compare rates before choosing

Comparing multiple lenders helps you save money on total interest costs.

Final Thoughts

Roof financing makes it easy to replace a roof even when the total cost seems high. With home equity loans, personal loans, contractor financing, and government programs, you can choose a plan that fits your budget and project needs. A well-financed roof replacement protects your home, increases value, and ensures you get long-lasting materials that offer an extended lifespan.

Check your estimated roof replacement cost with our roof replacement cost calculator and choose the financing option that fits your home and budget.

If you are still deciding between repairs and a full replacement, read Roof Replacement Cost vs. Repair Cost: Which Option Saves You More?

Can I finance a roof replacement if I don’t have home equity?

Yes. You can use a personal loan or contractor financing to cover roof replacement costs without using home equity. Many lenders offer unsecured personal loans, and some roofing companies partner with lenders to offer financing directly.

What credit score do I need to get a roof financing loan?

For a personal loan or standard financing, lenders often prefer a credit score in the mid-600s or higher for favorable rates. Lower scores may still qualify, but interest rates or terms will likely be less attractive.

Can I finance just repairs instead of a full roof replacement?

Yes. Financing applies not only to full roof replacement but also to partial repairs or upgrades. Many financing plans are flexible enough for smaller roofing projects or repairs.

How long does roof financing usually last?

Typical financing terms range from 2 to 10 years for personal loans or contractor plans. Home equity loans or HELOCs may extend longer depending on the lender's terms.

Will financing affect the quality of roofing materials or workmanship?

No. Financing only affects the payment method. You can still choose high-quality roofing material — whether asphalt shingles, metal roofing, tile roof, or slate tiles and work with reputable roofing contractors or a reputable roofing company. Financing gives flexibility, not compromise.

Can I get financing quickly, or do I need to wait weeks?

Yes. Many financing options, including contractor financing and personal loans, offer quick approval, often within 24 to 48 hours. This allows you to start your roofing project soon with minimal delay.