Is Roof Replacement Covered by Insurance?

- Insurance is cause-based: Insurance will cover sudden damage such as storms, hail, or fire, but will not cover natural aging or wear.

- Documentation is essential: Photos, a report of inspection, and receipts all make your claim more legitimate.

- Policies vary: Every homeowner's insurance policy varies and has varying rules, limits, and deductibles.

- Haste is good: Reporting the damage early enhances your chances of your claim being accepted.

- Windstorms & Hail: Wind and hail were the #1 cause of homeowners' insurance claims, accounting for 40% of all claims, according to the Insurance Information Institute. When shingles blow off, insurance usually bails you out.

- Fire: Either a house fire or wildfire, a burnt roof is most often covered.

- Lightning strikes: Rare, but catastrophic, are most often included in standard policies.

- Falling trees or debris: If a tree or large branch falls through your roof, that's unexpected damage.

- Normal wear & tear: Shingles are not immortal. Most asphalt roofs last 15–20 years, and if yours is just old, that's on you.

- Neglect: If you've let small leaks go on for years and now the roof is rotted, insurers will not cover.

- Improper installation: Insurance assumes your roof was installed correctly to begin with.

- Cosmetic-only damage: If hail leaves small dents but doesn't actually affect functionality, most insurers won't cover replacement.

- Actual Cash Value (ACV): This is what your roof is worth after it has depreciated. If your roof is 15 years old, the insurance will pay based on how old it is. For instance, if a new roof will cost you $15,000 but your old one is worth only $6,000 because of depreciation, that's what you'll receive.

- Replacement Cost Value (RCV): This pays for the amount it would take to replace the roof with a new one, less your deductible. In our example, if your roof takes $15,000 to replace, the company would pay that entire figure (minus deductible), irrespective of its age.

- Wind or hail affects more than one slope, rendering repairs not practical.

- A tree or storm debris creates structural damage.

- Fire, lightning, or tornadoes burn or shatter big chunks of the roof.

- Matching laws in your state mandate a full replacement if repairs won't visually match.

- The damage is merely cosmetic (hail dings on metal roofs, for instance).

- The roof has already passed its lifespan.

- Neglect led to the issue.

- Here's the reality: even if your roof is insured, you're still going to pay something.

- Flat Deductibles: $1,000–$2,500 is typical.

- Percentage Deductibles: In storm states (such as Texas or Florida), you may have a 2% deductible. On a $300,000 house, that's $6,000 out of pocket.

- Small repairs (patches, handful of shingles): $2,000–$5,000

- Asphalt shingle replacement on a standard basis: $8,000–$12,000

- Metal or tile roofs: $15,000–$30,000

- Respond fast: File your claim within days, not weeks. Insurance providers often deny late claims.

- Get annual inspections: A well-maintained roof with inspection records shows you’ve done your part.

- Hire a roofing contractor before the adjuster visits: A reputable roofing contractor can point out issues that an insurance adjuster might miss.

- Know your policy: Knowing the coverage limits and whether you have ACV or RCV coverage makes you a better advocate for yourself.

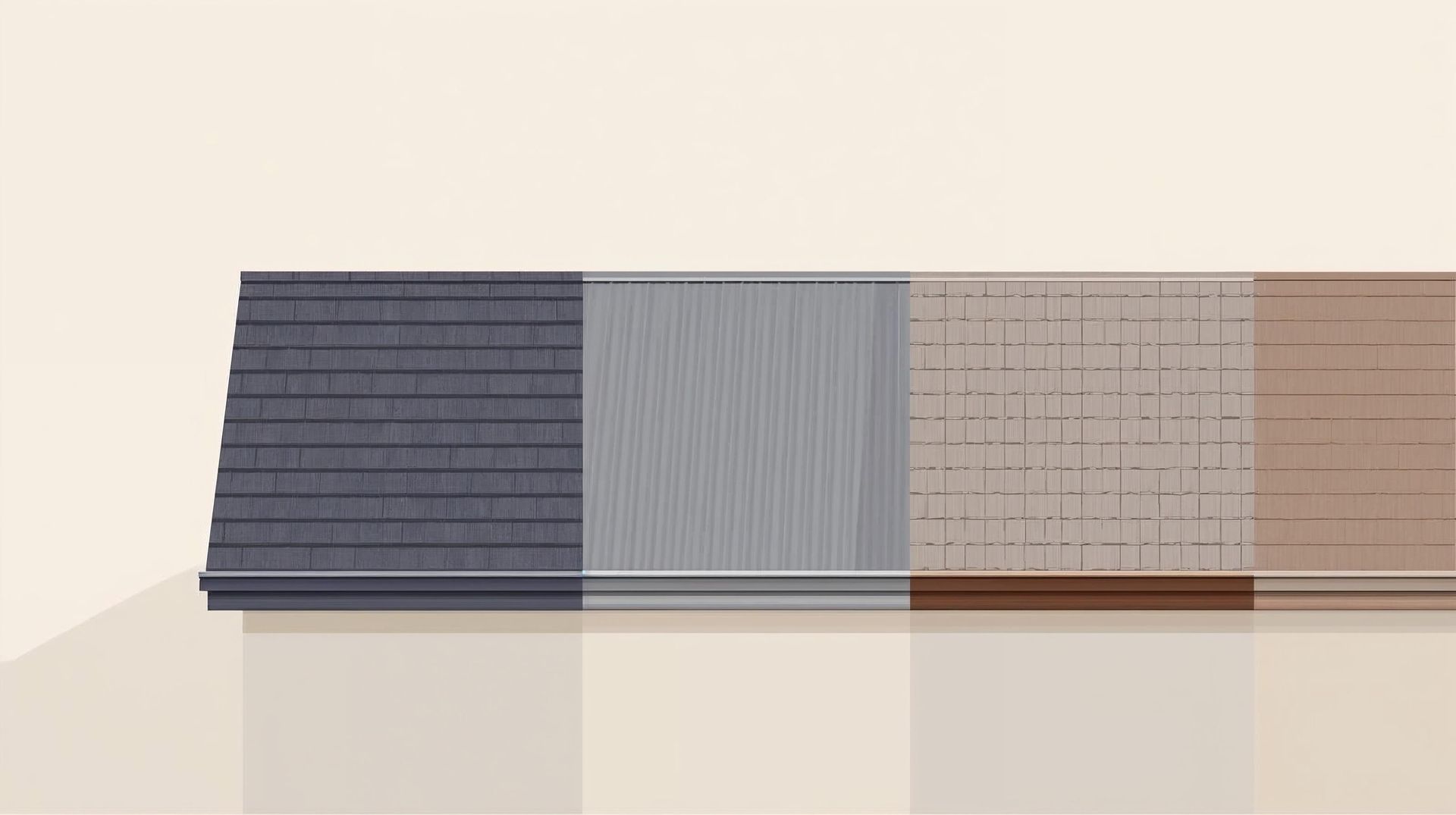

- Impact-resistant shingles: Enhanced protection against wind and hail damage, which in some cases can lower premiums.

- Metal roofs: More costly upfront, but they last 40–70 years. Insurance companies like their durability.

- Enhanced underlayment & ventilation: Assists your roof in meeting building codes and increases its lifespan.

- Financing from the roofing company: Most quality roofing companies provide low monthly payment arrangements.

- Home equity loans or HELOCs: Usually less expensive than high-interest credit cards.

- State or federal disaster aid: For catastrophic events, such as hurricanes or tornadoes.

- Upgrades are within reach: Paying $500 for repairs now can keep you from shelling out $5,000 later on crisis-level repairs.

- Waiting months before filing.

- Fixing the roof before the insurance adjuster can look at it.

- Discarding damaged shingles (they're your evidence).

- Thinking all forms of roof damage are covered.

- Storm, hail, fire, or fallen tree? → Probably covered.

- Old roof, neglect, leaks? → Not covered.

- Not sure? → File anyway. Worst-case is a denial.

- Claim call script: What to say when you call your insurance agent.

- Roof inspection checklist: Helps document a well-maintained roof.

- Photo log template: Keeps proof organized for your insurance provider.

- Not all roofing damage is insured.

- ACV vs RCV can turn your approval around.

- Prompt action, proper records, and expert guidance boost chances of approval.

Will insurance cover roof leaks and small repairs?

It depends on why the problem occurred. If a covered cause, like storm or wind loss, created the leak, your policy might pay for the repair. But if it was from an aged roof or not having any maintenance done, it's generally not covered under your roof coverage. Be sure to read your regular homeowners' insurance policy to be sure.

How do I choose a good roofing company to use for insurance claims?

It is better to have a good roofing company or a good roofing contractor when filing a claim. They can take good inspections, pictures, and quotes that will prove your roof damage is authentic. Also, insurers usually trust reports from experienced contractors, and that makes it more possible that you might succeed in getting your insurance to cover roof replacement or repair.

How do I make good home insurance claims for roof damage?

With home insurance claims, the details are crucial. Document everything clearly with photos, note the specific date of the occurrence, and have a professional inspection done by a well-established roofing contractor. Homeowners often make the error of waiting too long or patching up something before the adjuster arrives. By doing all this and working with professionals early on, your insurance coverage has a greater chance of becoming operational.

Will insurance replace the entire roof if only a partial is damaged?

Yes, in some states. Matching laws mandate full replacement if new shingles will not visually match old ones.

Do I require multiple contractor bids?

Not obligatory, but wise. It provides leverage if the insurance estimate is too low.

Will the majority of homeowners' policies cover a complete roof replacement?

Most homeowners' insurance policies do cover a full replacement, but only if the roof damage is covered under your plan. For example, if a tree falls during a storm or high winds rip off shingles, your home insurance company will likely step in to help. But if the issue is simply due to an old or neglected roof, you’ll probably be paying out of pocket.

Can my lender hold the insurance check?

Yes. Mortgage lenders sometimes co-sign the check to make sure repairs are completed.