Cost of Roof Replacement with Insurance: What You Should Know

- ACV = depreciated value

- RCV = Full replacement cost (minus deductible)

| Policy type | How it works | Impact |

|---|---|---|

| Actual Cash Value | Replacement cost minus Depreciation | Lower payout; more out-of-pocket expense |

| Replacement Cost Value | Full cost to replace minus deductible | Better coverage, fewer out-of-pocket expenses |

For instance, with RCV, your insurer might cover a $15,000 replacement minus your deductible regardless of your roof's condition. But with ACV, depreciation might drastically reduce that coverage, even to zero for an aging roof.

Factors impacting your Coverage and Cost

Ever wondered why a homeowner's roof replacement is fully covered while another ends up paying thousands out of pocket? The difference often comes down to factors like roof age, the type of damage, and your specific insurance policy. Let's take a closer look at what really impacts cost and coverage.

Age of the roof

- Insurance companies often reduce coverage as the roof gets older.

- Many policies limit or exclude coverage for roofs 15-20 years old.

- Older roofs are more likely to be covered at Actual Cash Value (ACV) (diminished value) rather than Replacement Cost Value (RCV).

- Example: A 5-year-old roof may be covered for a full replacement, while a 20-year-old roof may only qualify for partial reimbursement.

Cause of damage

- Sudden, accidental, or weather-related damage (hail, wind, storm, fallen tree) is typically covered.

- Wear and tear or gradual deterioration is not covered under most homeowners insurance policies.

- Example: Hail damage to shingles is usually covered, but leaks caused by years of neglect won't be.

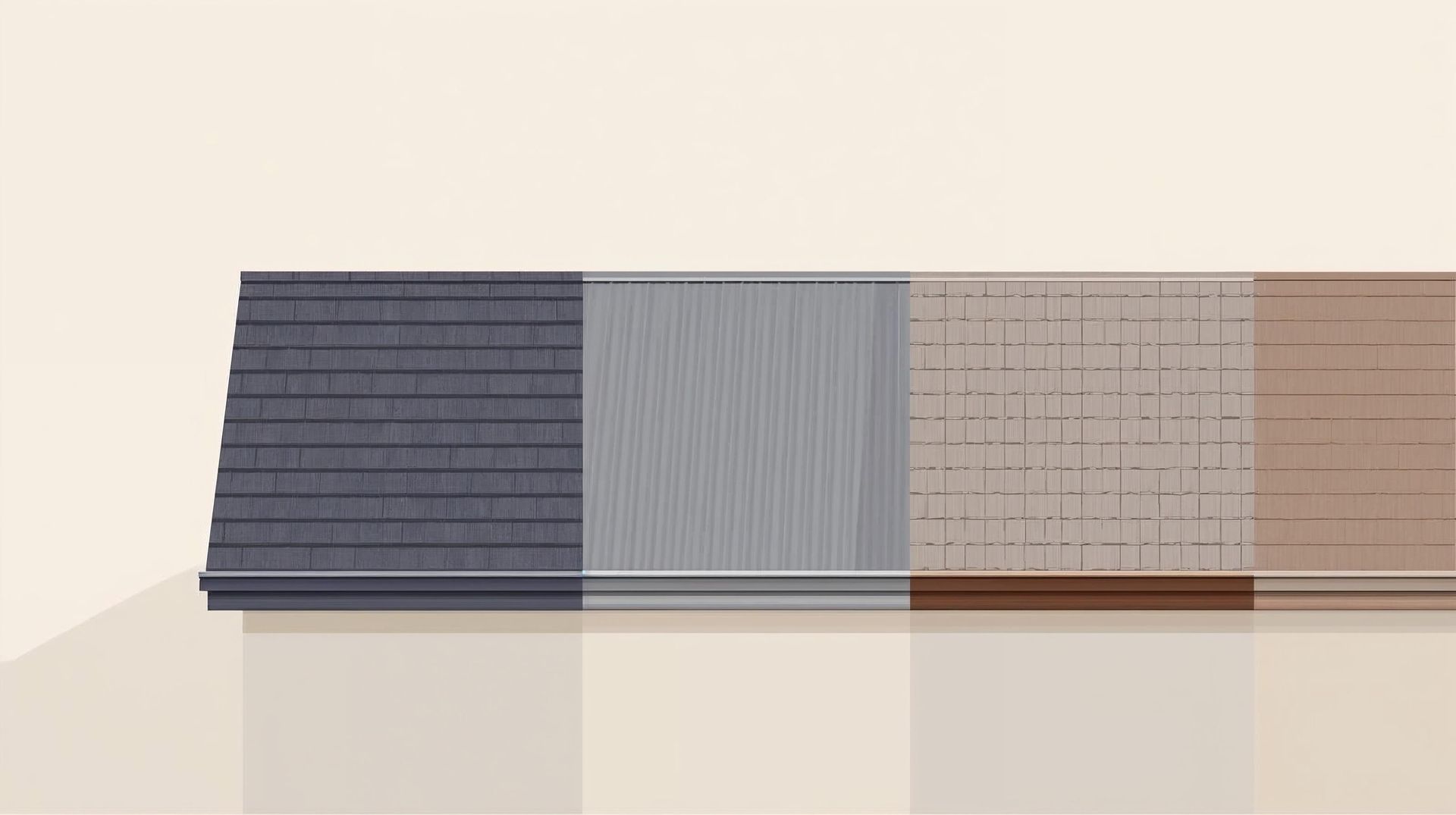

Roofing materials

- Asphalt Shingles: Most common, cost-effective, usually covered fully if damaged by storms.

- Metal Roofs: Higher upfront cost, but more durable (may reduce claim frequency).

- Tile, Slate, or Wood Shake roofs: More expensive to replace, and some insurers may require higher premiums or limit coverage.

Maintenance & condition

- Insurance companies often inspect the roof condition before approving a claim.

- Poorly maintained roofs (missing shingles, clogged gutters, mold, prior not repaired damage) may result in claim denial.

- Homeowners are expected to perform regular maintenance, like fixing minor damage before it becomes severe.

Insurance provider policies

Coverage terms vary widely among providers.

- Some policies cover full replacement cost for newer roofs.

- Others switch to reduced payout after 10-15 years.

- Deductibles (what you pay out of your pocket) also varies.

The type of policy (ACV vs. RCV) directly affects payout.

Climate and losses

- If you live in a region prone to hail, hurricanes, or tornadoes, insurers may impose higher deductibles or stricter terms.

- Example: In coastal areas, hurricane-related roof claims may come with special windstorm deductibles.

- States with frequent weather events (like Texas, Florida, and Oklahoma) often see higher premiums and stricter coverage rules.

- Climate also affects roof lifespan: heavy snow, ice, or heat can shorten roof durability, impacting both costs and insurance payouts.

Step-by-Step: Roof Insurance Claim Process

Step 1: Document the damage

- Take clear photos/videos after the event (storm, hail, wind).

- Note dates and areas affected.

- Prevent further damage (tarp if needed).

Step 2: Review your policy & deductible

- Check if you have ACV (actual cash value) or RCV (replacement cost value), any exclusions (gradual damage), and your out-of-pocket amount.

Step 3: Contact your insurance company

- Report the loss, open a claim, get a claim number, and ask what documentation they require.

Step 4: Get a professional inspection & estimate

- Have a licensed roofer inspect your roof and provide you a written estimate.

- This helps you compare with the adjuster's scope.

Step 5: Adjuster inspection

- Meet the adjuster (ideally with your roof present).

- Walk the roof, align on cause (storm vs. wear), quantities, and roofing materials.

Step 6: Claim decision & payout structure

- RCV policy: Initial check for ACV (minus deductible), then recovered depreciation is paid after work is completed.

- ACV policy: One check for diminished value (minus deductible).

- Review the estimate for missing items (flashing, ventilation, disposal).

Step 7: Do the work & submit completion docs

- Hire the contractor, complete the roof replacement, then send the final invoice, photos, and any permits to release depreciation (RCV) or supplements (if needed).

How much will Insurance pay for a Roof Replacement?

When it comes to coverage, the amount your insurance pays depends on why the damage happened, your policy type, and your roof's condition.

Full coverage

- Often applies if your roof is damaged by storms, hail, or wind.

- Insurance may pay the full restoration cost, minus your out-of-pocket amount.

- For example, If a storm rips off shingles, your insurer usually covers both materials and labor.

Partial coverage

- If your policy factors in depreciation (roof's age), you may only get a portion of the replacement cost.

- For instance, if your 15 year old roof has a 30 year lifespan, you'll only be reimbursed for the remaining value, not the cost of a brand-new roof.

Cost Breakdown

- Expect expenses for labor, roofing materials, disposal of old shingles, and possible extras like permits or inspections.

Surprises to watch for

- Upgrades (premium shingles, metal roofs), building code upgrades, or better ventilation may not be covered.

- These usually come out-of-pocket.

Budgeting tips for Homeowners

Even with insurance, you'll likely face some costs. Here's how to prepare:

Save for your deductible

- Policies require homeowners to pay a deductible first, so it's smart to keep an emergency fund set aside for this.

Repair vs. Replacement

- Sometimes repairing a section of the roof makes more sense financially than replacing it all. But if the roof is old, replacement can be a better long-term investment.

Get multiple estimates

- Always compare at least 2-3 roofing contractors with their estimates.

- Prices can vary by thousands of dollars for the same job.

Think long-term with materials

- Asphalt shingles may be cheaper upfront, but Metal or Slate roofing lasts longer and may reduce costs over time.

Prevent higher costs with maintenance

- Cleaning gutters, checking flashing, and annual inspections can save you from future costly repairs.

Common Mistakes Homeowners Make with Insurance Claims

Handling a claim can get stressful but make sure you don't fall into these traps:

- Not reading your policy: Every policy has limits, exclusions, and fine print. If you don't understand what's covered, you could be in for a shock later.

- Delaying your claim: Most insurers require prompt reporting after damage. Waiting too long could lead to denial of insurance benefits.

- Ignoring small damage: Minor hail or wind damage can worsen over time. Insurance is subjected to then deny it as "wear and tear" instead of storm damage.

- Accepting the first estimate: Insurance adjusters can undervalue the cost. Always compare with contractor estimates before agreeing.

- Forgetting roof age matters: Older roofs is likely to only qualify for partial payouts under ACV policy. Know your roof's age before filing.

How to choose the right Roofing Contractor

Your contractor makes a huge difference in both the repair quality and the insurance process.

Choose the right roofing contractor by:

- Looking for licensed, insured, and experienced contractors (especially with insurance claims).

- Insisting on written, transparent estimates (no hidden costs).

- Picking contractors familiar with working alongside an insurance adjuster.

- Choosing someone who can explain the process clearly and guide you through the insurance paperwork.

Conclusion

When homeowners need help with roof coverage, knowing the details of what's covered, their options, and costs makes all the difference. Reviewing your policy and planning ahead gives you peace of mind and the right protection for your home.

Want to know how much a new roof might cost and how much your insurance will cover?

Use our Roof Replacement Cost Calculator to get an instant estimate. Then get a free professional roof inspection to compare quotes and file your claim with confidence!

The more you know, the better prepared you'll be to protect your home and save money.

How often are roof replacement claims filed?

About 3% of insured homes file claims annually.

Will filing a claim raise my premiums?

Potentially. It depends on your insurer, your claim history, and the nature of the claim.

Will my policy cover a full replacement after hail damage?

Often yes, but it depends on your policy type. Replacement cost coverage pays for a new roof, while actual cash value (acv) policies subtract depreciation.

How much does depreciation affect what I get paid?

The older your roof, the higher the depreciation. For example, a 15 year old roof may only be valued for a fraction of replacement cost.

How does deductibles work in the claim process?

Your deductible is the amount you pay before insurance kicks in. For example, if your initial payment was $2,000 and the replacement cost is $12,000, insurance pays only $10,000.